New to Medicare?

Medicare is a federal insurance program that we will all have to be on sooner or later and making that transition can be overwhelming. We are often left to find our own way.

Applying for Medicare can be complicated and confusing and when you are ready to enroll, most people do not know where to begin or who to even talk to. There are 2 basic time periods when someone signs up for Medicare:

Turning 65

If you are collecting Social Security before you are 65, you will automatically get your Medicare card in the mail with Part A and Part B. The start date will be on the first day of your birth month, except if you were born on the first day of the month, then your Medicare will start the month before on the first day.

If you are not collecting Social Security, you will have to sign up online through your My Social Security account, or by calling your local Social Security office. Medicare will give you a time frame to sign up without a penalty, three months before your birth month, your birth month, and three months after.

It is best to sign up in the first 3 months of your initial enrollment period (IEP) so that you can ensure a start date on the first day of your birth month. If you delay signing up in the last three months of your IEP, then you will delay the start of your Part B.

When You Are Over 65 and Coming Off of Your Employer Insurance or Retiring

If you are over 65 and coming off of your employer insurance and have Part A, you will need a CMS-L564 and you can apply for Medicare Part B by filling out the CMS-40B online and uploading the CMS-L564.

You will be enrolling in Medicare during a special enrollment period since you are coming off of your employer insurance. See the link below to apply online. Through this link, you can apply for Part B and upload your employment request form.

Sign Up for Medicare During a Special Enrollment Period

The CMS-L564 is an employer request form that proves your creditable health insurance coverage since you have turned 65. Your employer has to sign it and by providing proof of health insurance coverage after 65, you can waive any late enrollment penalty.

You can also take your employment request form CMS-L564 and CMS-40B and drop them off at your nearest Social Security office in the drop box for processing. Sometimes this can be faster than online.

It can take up to 4 weeks to 60 days to process to make sure you get the process started about 3 months early to ensure an easy transition.

After helping hundreds of people through the process of both, we have learned some tips that can help. Signing up is not black and white for everyone and when you have questions about the process, we are your number one resource.

Before you ever sign up for Medicare, make sure you have a My Social Security account set up with a login. If you already have a login, you can sign up for Medicare through your My Social Security Account.

Click on the Apply for Medicare Link or Apply for Retirement Benefits. Once applied, you can follow up with the status of your application by logging into your My Social Security Account.

As you can probably tell, this process can seem overwhelming! Morgan Medicare Solutions is your number one resource to walk you through this process from sign-up to enrollment. Click here to download a tutorial.

Medicare 101 Webinar

Parts of Medicare

Part A

Part A is hospital insurance benefits and covers your hospital stays and other inpatient stays including skilled nursing, in-patient rehabilitation, home health, and hospice.

This part of Medicare has no premium if you have worked 40 quarters or 10 years and paid your Medicare taxes. To see if you qualify for premium-free part A, check your My Social Security account.

Part B

Part B is your Medical Insurance benefit, covering your doctor visits and all outpatient tests and procedures. This part of Medicare also includes medications that are administered by a skilled clinician in a doctor’s office, such as vaccines and intravenous medications.

This part of Medicare has an annual deductible and you will pay 20% coinsurance of all services once the annual deductible is met. This is the part of Medicare you will pay a monthly premium for. Currently, the base rate is $174.70 and can change each year. You will pay more for Part B if you are a high earner.

This rate is based on your modified adjusted gross income from two years ago. For example, if you go on Medicare in 2024, Medicare will look back to your MAGI from 2022 to set your Part B premiums.

Part C

This part of Medicare is the Advantage Plan, which is an all-inclusive plan, including the benefits of Part A and Part B and most of the time, Part D (drug coverage). These are private insurance plans that contract with Medicare having networks and cost-sharing for healthcare expenses.

They are HMOs and PPOs and where you live and what plans your doctors and what your drugs cost guide your choice of plan. These plans are also known as Medicare replacement plans.

Part D

Drug plans are required by Medicare and it is highly recommended that you sign up for one when you are first eligible for Medicare. If you sign up later, you will get a late enrollment penalty.

Drug plans can stand alone, included in an Advantage Plan or you can use the VA if you are a veteran. All are different in premiums, drug formularies, and deductibles and can change every year.

Drugs are categorized into Tier levels, 1-5. The higher the tier, the higher the cost. Drug Plans can be changed during the annual enrollment period, October 15 – December 7.

Part A

Part A is hospital insurance benefits and covers your hospital stays and other inpatient stays including skilled nursing, in-patient rehabilitation, home health, and hospice.

This part of Medicare has no premium if you have worked 40 quarters or 10 years and paid your Medicare taxes. To see if you qualify for premium-free part A, check your My Social Security account.

Part B

Part B is your Medical Insurance benefit, covering your doctor visits and all outpatient tests and procedures. This part of Medicare also includes medications that are administered by a skilled clinician in a doctor’s office, such as vaccines and intravenous medications.

This part of Medicare has an annual deductible and you will pay 20% coinsurance of all services once the annual deductible is met. This is the part of Medicare you will pay a monthly premium for. Currently, the base rate is $174.70 and can change each year. You will pay more for Part B if you are a high earner.

This rate is based on your modified adjusted gross income from two years ago. For example, if you go on Medicare in 2024, Medicare will look back to your MAGI from 2022 to set your Part B premiums.

Part C

This part of Medicare is the Advantage Plan, which is an all-inclusive plan, including the benefits of Part A and Part B and most of the time, Part D (drug coverage). These are private insurance plans that contract with Medicare having networks and cost-sharing for healthcare expenses.

They are HMOs and PPOs and where you live and what plans your doctors and what your drugs cost guide your choice of plan. These plans are also known as Medicare replacement plans.

Part D

Drug plans are required by Medicare and it is highly recommended that you sign up for one when you are first eligible for Medicare. If you sign up later, you will get a late enrollment penalty.

Drug plans can stand alone, included in an Advantage Plan or you can use the VA if you are a veteran. All are different in premiums, drug formularies, and deductibles and can change every year.

Drugs are categorized into Tier levels, 1-5. The higher the tier, the higher the cost. Drug Plans can be changed during the annual enrollment period, October 15 – December 7.

Medicare Options

Now that you have signed up for Medicare and have your ID, you need to sign up for your Medicare option. You have two options to choose from.

Option 1 - Traditional or Original Medicare, Part D, and a Medigap

This option is where Medicare pays primary and you have a Medigap to cover the rest, the 20% that Medicare does not cover. You pay for services as you get them, Medicare pays their part and you pay yours.

You can also add a Part D drug plan to cover your prescriptions and a Supplement to Medicare to cover your share of costs. You can go to any provider that accepts Medicare.

Option 2 - Advantage Plan, Part C

This option is a Medicare replacement or alternative to Original Medicare coverage. It is a Medicare-approved plan from a private insurance company that offers the same benefits as Part A and Part B and most include Part D.

On an Advantage Plan, you will have co-pays. Some plans offer extra coverage that Medicare does not provide such as dental, hearing, and routine vision. These plans have doctor networks and you must go to doctors within the plan’s networks.

You also must be enrolled in Medicare Part A and Part B to enroll in this option of Medicare and also pay your Part B premiums.

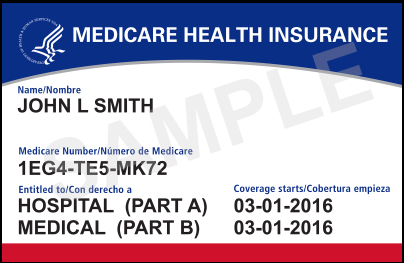

Your Medicare Card

Your card has a Medicare Number that’s unique to you — it’s not your Social Security Number. This helps protect your identity. The card shows:

Once you’re signed up for Medicare, a welcome packet will be mailed to you. You can also log into (or create) your secure Medicare account to print your official Medicare card.

We are licensed to offer plans in 18 states: Texas, Oklahoma, Colorado, New Mexico, New Jersey, Virginia, South Carolina, Alabama, Louisiana, Arkansas, California, Florida, Hawaii, Kentucky, Maryland, Massachusetts, Minnesota, and Tennessee.